How to use multiple accounts for better budgeting

One of the first steps founders take when a Canadian business is setting up a dedicated business checking account.

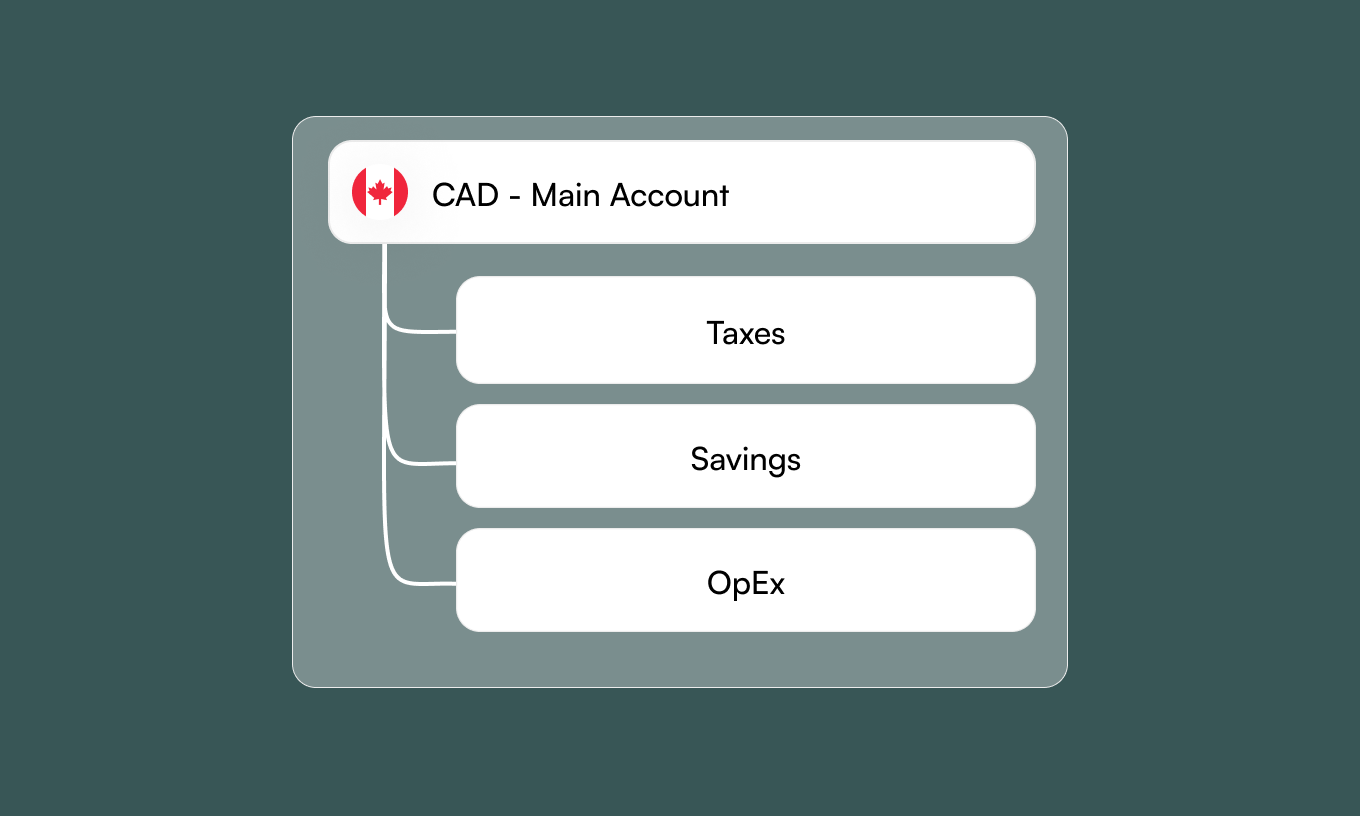

How to use multiple business checking accounts for better budgeting:

One of the first steps founders take when a Canadian business is setting up a dedicated operation account.

But as the business grows, more than one account is often needed.

In Canada where 30+% of businesses fail because of financial problems, allocating income and expenses across multiple business checking accounts can give founders a birds-eye view of their startup’s financial situation, helping them make smarter decisions.

And thanks to online banking, organizing and managing a startup’s banking infrastructure is now easier than ever. Let’s explore how multiple business checking accounts can improve budgeting and how a founder might arrange their banking infrastructure for effective income and expense management.

What are the benefits of having multiple business checking accounts?

Maintaining multiple business checking accounts can support your business in several key ways:

Financial organization. Maintaining multiple accounts with specified purposes clarifies a business’s financial status. With a glance, founders can see if they have enough to cover the next payroll cycle or if they can afford that new piece of equipment. If the business is short in one expense category, it can simply move cash from one account to another. Having its finances in order can also make it easier for the business to determine how much runway it has and when it needs to raise a new round of financing.

Recordkeeping. Most startups create quarterly financial statements — but financial decisions happen a lot more frequently. A startup’s bank statements can provide detailed and timely insight into crucial income and expenses. Leveraging multiple checking accounts can help break those financials down further and give a clear look into category-specific cash flows.

Tax prep. Having multiple checking accounts makes tax prep easier because it allows the business to automatically set aside cash to cover its quarterly or annual tax bill.

Manage spend. For specific operating expenses, like software subscriptions and travel, having a designated checking account allows the business to create dedicated credit or debit cards, making it even easier to track these expenses.

Security. Dividing funds across multiple accounts can safeguard your money from fraudulent activity or a breach of security.

Did you know?

Vault now makes it simple to use multi-account budgeting. Canadian companies can open additional accounts at no additional cost!

How to use it:

What are some examples of business checking accounts for bucketing your startup’s cash?

Again, the amount of checking accounts a startup may need should depend on the business’s major budget categories. Founders should consider where their business spends the most money and if it would be helpful to hone in on specific expense categories. Here are some examples of startup checking account categories that may be useful for budgeting:

Primary account

A primary checking account can be used to collect all business revenues before allocating that cash flow into respective expense accounts. This account should receive all direct deposits, wires, and invoices.

OpEx

An OpEx (operational expense) account should cover recurring monthly expenses related to running your business, such as rent, software subscriptions, third-party vendors, advertising/marketing, and utilities. Depending on the scale of the business and its specific operational costs, it may make sense to break out OpEx even further. For instance, a company that spends much on travel each month may consider a dedicated travel checking account. Meanwhile, a business that owns multiple brick-and-mortar stores may want to create separate OpEx accounts for each store.

Payroll

As a startup grows its team, managing payroll becomes increasingly complicated. Organizing a dedicated account for payroll and funding it regularly ensures the business never falls short of its payroll obligations.

Taxes

As mentioned, setting aside cash to cover taxes can provide peace of mind come tax season. It’s a good practice to set aside a portion of all accounts receivable equal to the business’s tax rate and transfer that directly into the tax account every time the company receives a new payment.

Using Sub-Accounts to Scale

Scaling your business means being smart about how you manage money. Setting up multiple business checking accounts to handle major cash inflows and outflows is a great way to ensure you’re working within your budget and positioning your business for long-term success.

Vault makes it easy for startups to manage multiple business checking accounts using our online banking platform.

Frequently asked questions

Everything you need to know about the product and billing.

Vault is the cheapest and easiest way to manage your business banking needs. We offer the best currency exchange rates in Canada, chequing accounts multiple currencies, domestic and international bank transfers, and a corporate Mastercard to manage all your spend. By signing up to Vault you automatically get:

- Accounts in Canadian dollars, US dollars, British pounds, and Euros

- Cheapest FX rates in Canada - Free domestic transfers (EFT, ACH, SEPA, FPS)

- A Mastercard Corporate card that gets you the same great FX rates

Transparency is key to us, that's why you'll find all of our fees listed on our pricing page: https://www.tryvault.com/pricing

We don't charge many fees and for the fees we do charge you'll find them to be well below market rates. You also get paid to use Vault via our cashback on card purchases!

We're only able to support Canadian corporations for now. If you have a sole proprietorship, partnership, or non-Canadian corporation we won't be able to support it at this time.

Yes, we have a direct integration with QBO and Xero. We are working on more integrations very soon!

Join 2,000+ businesses banking with Vault today

Streamline your business banking and save on your spend and transfers today